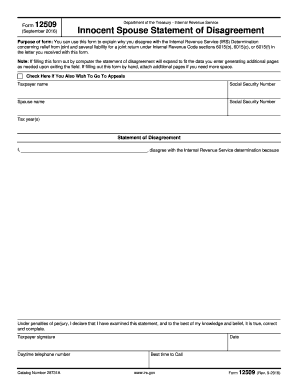

IRS 12509 2018-2026 free printable template

Instructions and Help about IRS 12509

How to edit IRS 12509

How to fill out IRS 12509

Latest updates to IRS 12509

All You Need to Know About IRS 12509

What is IRS 12509?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 12509

What should I do if I made a mistake on my IRS 12509 form?

If you realize you've made a mistake on your IRS 12509, you can submit an amended return. Ensure to clearly indicate that it is a correction and provide the appropriate explanations or corrections. Keeping copies of all documents is essential for your records.

How can I verify the status of my IRS 12509 submission?

To verify the status of your IRS 12509 submission, you can check the IRS e-file status tool, which provides updates on whether your form has been received and processed. Keep note of any rejection codes provided and refer to the IRS guidelines for necessary corrective actions.

What privacy measures should I consider when filing IRS 12509 electronically?

When e-filing the IRS 12509, it's crucial to use secure channels. Ensure that the software you are using complies with IRS guidelines and offers encryption for personal data. Additionally, consider the period for retaining records securely to safeguard sensitive information.

What common errors should I avoid when filing the IRS 12509?

Common pitfalls when filing the IRS 12509 include incorrect recipient information and failing to include necessary attachments. It's beneficial to double-check all details and ensure compliance with IRS guidelines to minimize errors and avoid submission delays.

How can I ensure compatibility of my device with IRS 12509 e-filing?

To ensure compatibility for e-filing the IRS 12509, verify that your device meets the technical requirements outlined by the IRS. Check for software updates and browser compatibility, and if necessary, test your setup with the IRS e-file platform to confirm functionality.

See what our users say